puerto rico tax incentives 2020

Obviously its a popular idea when people learn about it. For taxable year 2020 any holder of a tax incentives grant under Act No.

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Call us now at 404 445-8095 or request your free.

. The tax break was started by a Puerto Rican politician whod watched years of high taxes fail to improve life on the island. If you move to the island you can legally pay none. Puerto Rico tax and incentives guide 2020 5 Although economic growth has decreased during the last years Puerto Rico offers tax incentives packages which can prove attractive to companies from the United States and other countries.

The tax break was started by a Puerto Rican politician whod watched years of high taxes fail to improve life on the island. The updated requirements are mentioned in this article but for ease we have kept the original names Act 20 and Act 22 when discussing these. Want to pay no federal income tax.

The indictment describes an IRS sting operation wherein an undercover. An indictment filed October 14 2020 alleges that a senior tax partner Defendant of a large public accounting firm in Puerto Rico along with others known and unknowndevised and intended to devise a scheme and artifice to defraud the Internal Revenue Service. The purpose of incorporating the provisions of Act 216-2011 is to promote the purchase of eligible residential housing in Puerto Rico by providing incentives such as.

Theres also no capital gains tax. Puerto Rico Tax Incentives Redwood City California. 2020 by Trusts Taxes LLC.

Learn what the new requirements are and how they will affect you. These include a fixed corporate income tax rate one. You just have to give 4 of your income to Puerto Rico.

Find out how to shield your business and personal wealth from tax exposure while basking in the sun of Puerto Ricos sandy beaches. On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

Spend a minimum of 100000 in payments per project to Puerto Rico Residents including equipment crew travel and accommodations 50000 for short films. This resulted in some adjustments to the qualification requirements among other changes. Contact us today and we can help you make a decision of moving your business or a portion of it to Puerto Rico and pay 4 on export of services increasing your return on investment.

This page is dedicated to setting up a successful export business in Puerto Rico. Of particular interest are Chapter 2 of Act 60 for Resident Individual Investors and Chapter 3 for Export Services which shield new residents who live in Puerto Rico for at least half the year from paying. He decided to try something different.

Since 2012 Puerto Rico offers various tax incentives for both individuals and businesses. Move to Puerto Rico. 18 hours agoYou just have to give 4 of your income to Puerto Rico.

Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US. Tens of thousands have applied for the exemption and. Citizens that become residents of Puerto Rico.

We know how to coax every last tax credit and exemption out of Act 20 Act 22 and other government decrees to save you the most money possible on taxes. Ad We file Puerto Rican Hacienda US and Canadian returns. Act 169-2020 integrates real estate tax incentives established in Act 216-2011 to Subtitle F of the Incentives Code and extends said incentives until December 31 2030.

You should use common sense and rely on your own legal counsel for a formal legal opinion on Puerto Ricos tax incentives maintaining bona fide residence in Puerto Rico and any. As of 2020 Puerto Rico actually consolidated all of these tax acts into one Act 60 of the Incentives Code. 20 likes 1 talking about this.

60-2019 previous incentives laws or any special incentive law in Puerto Rico will be deemed to have complied with the following requirements contained in said grant as long as any failure to comply is directly related to the emergency caused by COVID-19. Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage. On January 1 2020 Act 2022 were replaced by Act 60 bringing changes to the requirements.

You should use common sense and rely on your own legal counsel for a formal legal opinion on Puerto Ricos tax incentives maintaining bona fide residence in Puerto Rico and any other issues related to taxes or residency in Puerto Rico. Puerto Rico Incentives Code 60 for prior Acts 2020. ACT 20 TAX INCENTIVES 4 Flat income tax rate on income related to.

The goal of tax planning is to legally limit minimize and if possible avoid US.

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

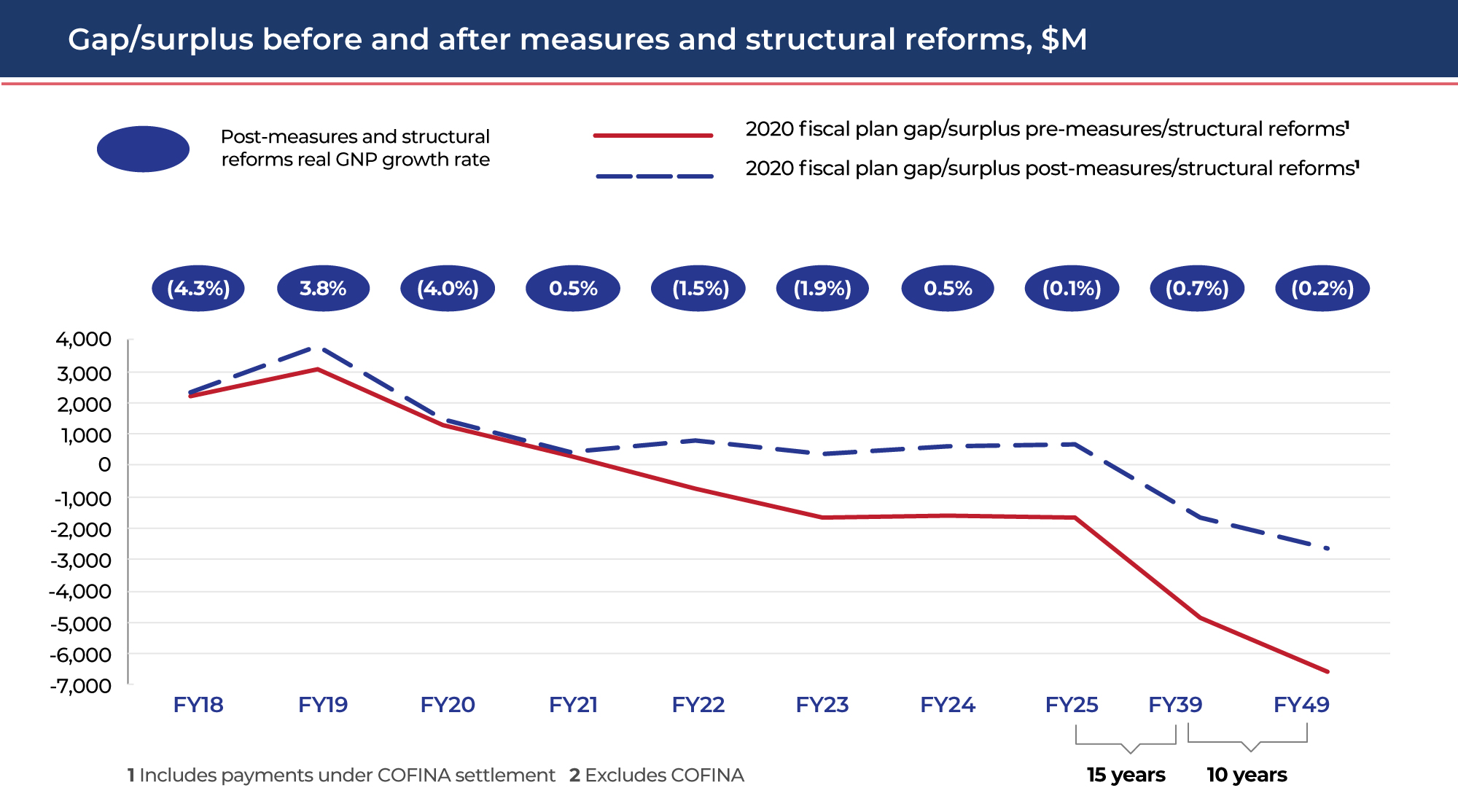

Cw Fiscal Plan Financial Oversight And Management Board For Puerto Rico

Guide To Income Tax In Puerto Rico

Tax Breaks For Crypto Millionaires Stir Outrage In Puerto Rico As Housing Surges Bloomberg

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

The Puerto Rico Tax Haven Will Act 20 Work For You

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Pr Relocation Guidebook Long Relocate To Puerto Rico With Act 60 20 22

Guide To Income Tax In Puerto Rico

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Tax Incentives Defending Act 60 Youtube

Everything You Need To Know About Puerto Rico Tax Incentives Epgd Business Law

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time